Florius Behavioural Design Sprint

Concept creation and validation for Florius Hypotheken

How might we convince Florius customers to periodically give insight in their home and financial situation in order to service them better?

The Challenge

The European Central Bank obliges mortgage banks such as Florius to be up to date on their customer’s financial situation (especially the ones with an interest-only mortgage) to prevent them from getting into financial trouble at the end of their mortgage term. Since sharing personal financial information periodically can be a somewhat tricky question to customers that requires a behavioral change I suggested to combine two proven workshop methods. The Behavioral design Canvas and the Design Sprint.

The Approach

By conducting in-depth interviews with Florius customers I gained insight in the pains and comforts of the current behaviour (not sharing financial information) as well as the gains and anxieties of the desired behaviour (periodically sharing financial information).

I found out that they are less hesitant to share their financial information than expected. Preconditions were that it should be shared in a safe environment and that they get valuable insights in return.

While applying for a mortgage customers already have to share a lot of information on their financial status and family situation so it would make sense to update that situation once in a while to learn what would be possible in the new financial situation. Perhaps a renovation, extra repayments to lower monthly fee or a lower interest rate are some perspectives.

These valuable insights were used to kick-off the 5 day behavioural design sprint in which the participants got taught the principles of behavioral design to incorporate the right moment, triggers and persuasive design principles in their solution sketch.

The Concept

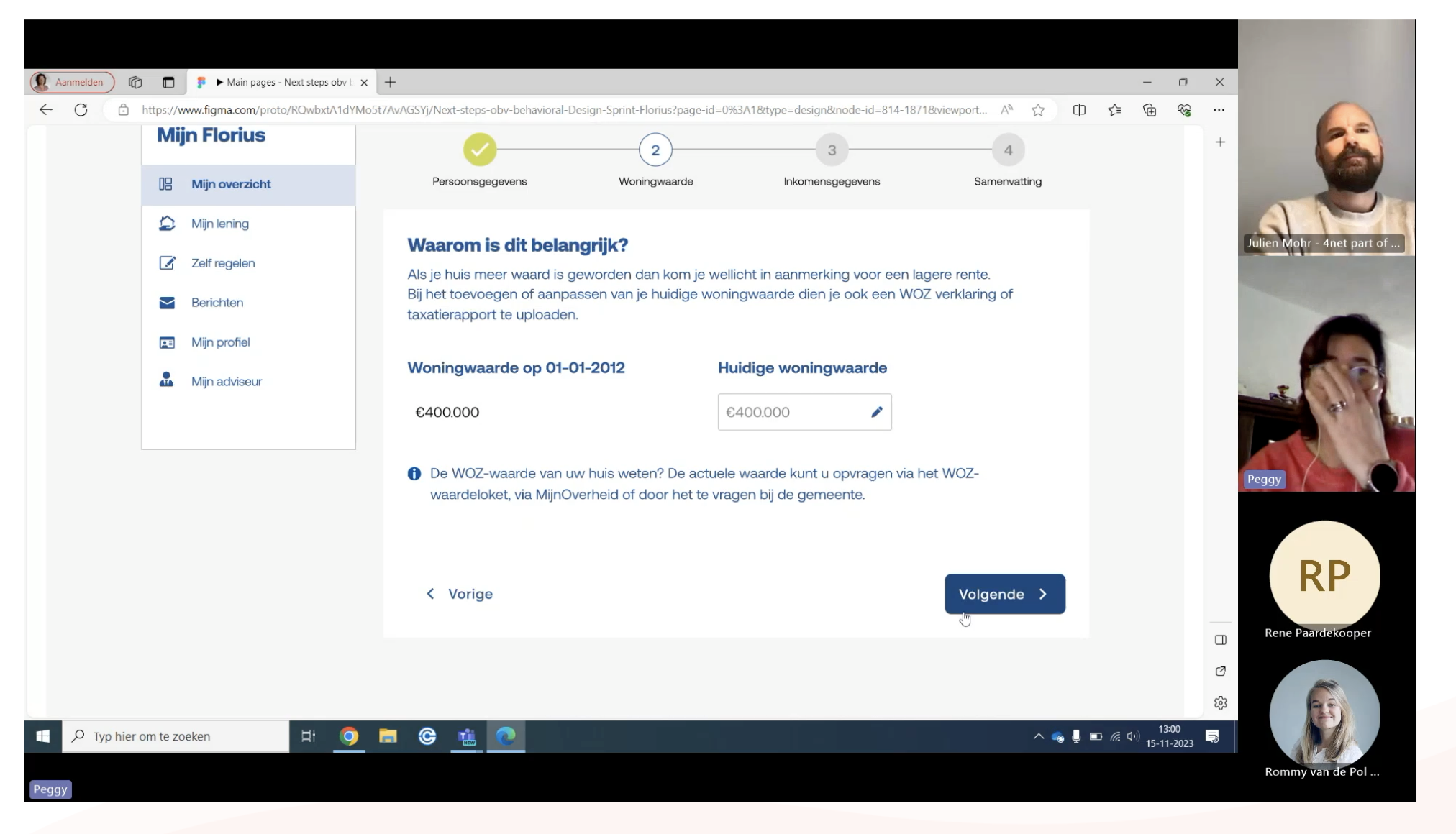

The winning concept was focused around the assumption that people are more willing to share information when the update questions move from easy to more financially sensitive.

A multi-step process was designed in which customers first have to check their personal information, the mortgage area’s they are interested in (renovating, moving or reducing monthly repayments) and finally updating their salary & savings account balance.

Based on the fields of interest and the updated financial status information is provided on new financial opportunities regarding their mortgage.

During the validation of the prototype with customers it became clear that the build up from easy personal to financially sensitive information was the right approach and customers are very willing to periodically update their financial information.

People in general are not much concerned with their mortgage on a daily basis so picking the right time to address updating information was critical. The yearly mortgage statement was a natural way to login to the Florius portal for tax return purposes. Customers received an alert after downloading the statement with the request to update their information which was percieved as logical point in time.

The Result

A validated interactive concept that proves that customers are willing to update their financial situation periodically in exchange for actionable mortgage insights.

A solid foundation for the design & development fase of the final application.

Actionable feedback based on Florius customer insights helped us refine the prototype and avoid obvious pitfalls after go-live.

Avoiding the ‘not invented here’ syndrome by means of broad stakholder alignment on the validated solution.

My role

-

Combining the Behavioral Design Canvas & the Design Sprint in a 5 day workshop program.

-

Conducting customer interviews to gather valuable insights before the Design Sprint.

-

Facilitating a group of 5 Florius stakeholders and 2 UX & UI designers during the Behavioral Design Sprint process.

-

Validating the interactive prototype by conducting 7 interviews focused on comprehension, usability and optimization.

-

The outcomes of the validation interviews provided clear optimizations that were included in the prototype during an Iteration Sprint and revalidated with Florius costomers. The result was an optimized concept and application roadmap for further design and development.

CLIENT CASES